NORMA Group increases sales to over EUR 1.2 billion in 2022

Maintal, Germany, March 28, 2023

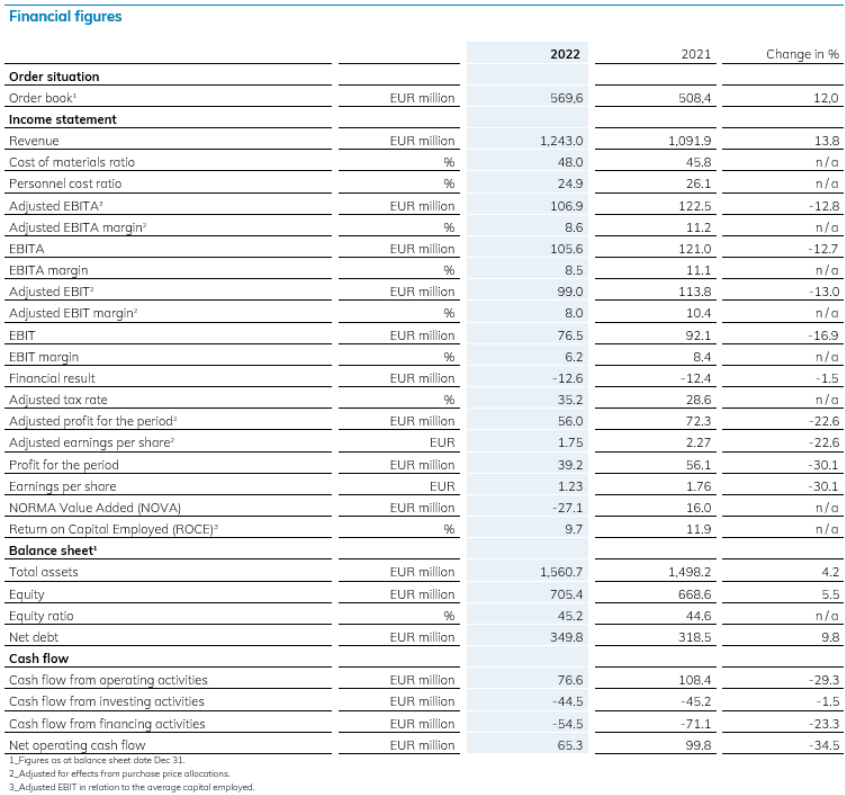

- Sales growth of 13.8% to EUR 1,243 million

- Adjusted EBIT margin at 8.0 percent

- Dividend of EUR 0.55 per share proposed

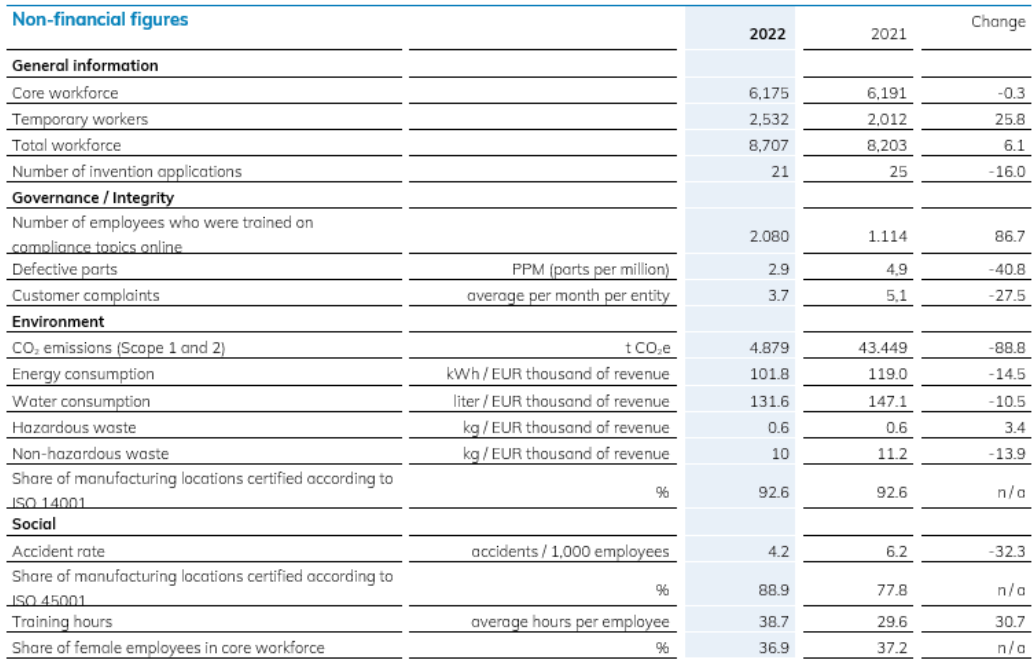

- CO2 emissions reduced by 88.8 percent thanks to purchase of electricity from renewable sources

- Forecast 2023: medium single-digit organic sales growth; adjusted EBIT margin around 8 percent

NORMA Group today announced its final figures for financial year 2022 together with its outlook for the current financial year. The company generated Group sales of EUR 1,243.0 million in 2022, corresponding to 13.8 percent increase over the previous year (2021: EUR 1,091.9 million). Organic sales growth amounted to 7.1 percent, driven by the consistent pricing policy implemented by NORMA Group as a means to cushion the impact of inflation. Positive currency effects from the strong US dollar also made a significant contribution to growth. All three business regions made a positive contribution to growth.

Adjusted earnings before interest and taxes (adjusted EBIT) fell 13.0 percent from the prior-year level to EUR 99.0 million (2021: EUR 113.8 million). The adjusted EBIT margin was 8.0 percent (2021: 10.4 percent). Earnings and margin were impacted by higher costs for energy-intensive raw materials including steel and plastic resins, higher logistics costs and special costs incurred in connection with the introduction of a globally standardized ERP system. Additional temporary workers were also needed at times to support production relocations and to eliminate the backlog of customer orders. Net operating cash flow amounted to EUR 65.3 million (2021: EUR 99.8 million).

CEO Miguel Ángel López Borrego: “We managed to achieve growth in a challenging environment in 2022. It was possible to pass on inflation-related increased costs for materials and logistics to a significant extent through higher selling prices. We intend to continue building on our sound, diversified business model and work to serve our customers even better. The signs for 2023 clearly point toward profitable growth in our three strategic business units industry, water management and mobility.”

Development in the business regions

In the Americas region, sales growth was strong at 25.7 percent and reached EUR 574.2 million. That makes it the fastest growing business region with a total contribution of 46 percent to Group sales. In addition to substantial organic growth of 11.9 percent, positive currency effects due to the strong US dollar made a major contribution of 13.9 percent to this increase in sales. Business with standard joining products developed very positively overall, posting an increase of 25.8 percent (organically: 12.0 percent) compared to the prior-year period. This includes the US business with irrigation and drainage products, an area that has been growing for years. This water management business increased significantly once again, with 12.4 percent organic growth in 2022. A number of price increases helped offset the inflation-related increase in the cost base. As a result of the significant increase in production figures for light and heavy vehicles in the Americas, coupled with higher prices, the automotive sector also provided positive growth momentum. Overall, sales of the automotive business in the Americas region increased by 25.4 percent in 2022 (organically: 11.4 percent).

In the EMEA region (Europe, Middle East and Africa), sales increased by 5.8 percent to EUR 489.2 million in 2022 (2021: EUR 462.4 million). Organic growth of 6.1 percent was diminished by 0.3 percent due to negative currency effects. The automotive joining technology business recovered in the second half of the year following what at times were considerable disruptions to the European automotive industry as a result of the Russian invasion of Ukraine. NORMA Group’s business in this area grew by 9.5 percent in the full year. The main driver of this growth was higher selling prices, which NORMA Group used to compensate for inflation-related price hikes for raw materials and intermediate products. In the area of standardized joining technology for distributors and wholesalers, sales were down in financial year 2022, falling slightly by -4.3 percent. The sluggish business was due in part to capacity bottlenecks at some production sites. The company countered these bottlenecks in the second half of the year with efficiency measures and an increased level of interdisciplinary cooperation.

In the Asia-Pacific region, NORMA Group grew by 3.9 percent to EUR 179.6 million in financial year 2022 (2021: EUR 172.8 million). Currency effects accounted for a positive impact of 6.5 percent; organically, business in the region developed negatively at -2.6 percent. Restrained development in this region was primarily due to the weak automotive business in China as a consequence of the prolonged Covid lockdowns in that country. In the area of standard joining solutions, the region grew by 6.6 percent in the financial year (organically: 1.2 percent).

Proposed dividend: EUR 0.55 per share

Management Board and Supervisory Board of NORMA Group will propose to the Annual General Meeting on May 11, 2023, the distribution of a dividend of EUR 0.55 per share to the shareholders for financial year 2022. This corresponds to a distribution volume of about EUR 17.5 million. The planned payout ratio is thus almost 31.3 percent of the adjusted net profit in financial year 2022 of EUR 56.0 million.

CFO Annette Stieve: “We remain focused on our sustainable growth strategy, even in challenging times. With the proposed dividend we are adhering to our long-term dividend policy and intend to distribute approximately one-third of adjusted net profit to our shareholders.”

2022 environmental target achieved: CO2 emissions reduced by 88.8 percent

NORMA Group is committed to reducing greenhouse gas emissions at its production sites as part of the environmental strategy the company developed in 2018. NORMA Group currently focuses on emissions resulting from gas consumption and the purchase of electricity and district heating at its production sites in terms of recording and managing its greenhouse gas emissions. Since January 2022, NORMA Group has been purchasing electricity from renewable sources at all 27 production sites worldwide. This was the main reason why in 2022 emissions from gas consumption and the purchase of electricity and district heating at the plants were 88.8 percent lower than in the previous year at 4,879 metric tons of CO2 equivalents (2021: 43,449 metric tons).

In its combined Annual and Corporate Responsibility Report 2022 published today, NORMA Group provides information on further progress in the areas of environment, social and governance (ESG). NORMA Group’s significant non-financial performance indicators include CO2 emissions, the number of invention applications and the number of defective parts per million parts produced.

Forecast 2023: Profitable growth in an uncertain environment

Overall, NORMA Group anticipates medium single-digit organic Group sales growth for financial year 2023. With regard to profitability, the Management Board expects an adjusted EBIT margin of around 8 percent for 2023. The targeted figure for net operating cash flow is around EUR 70 million.

For the Americas region, NORMA Group expects low single-digit organic sales growth in 2023. Both continued growth in the US water business and a good development in the automotive business for light and heavy vehicles will likely make a positive contribution here.

For the EMEA region, NORMA Group forecasts organic sales growth in the medium single-digit range in 2023. Expected growth drivers include continued favorable development of demand from the European automotive industry as well as positive development of business with distributors and wholesalers in the area of standardized joining technology.

In the Asia-Pacific region, NORMA Group expects organic sales growth in the low double-digit range. Good demand for joining solutions and expanded production in China are expected to make a positive contribution.

Miguel Ángel López Borrego: „We expect momentum in the global economy to continue to be burdened by geopolitical tensions and challenges in the energy and commodity markets in 2023. Given our well-filled order books and the forecast development of key customer industries, we are taking a deferential but optimistic view of the financial year 2023. We will grow profitably in an uncertain global economic environment and expect to achieve an adjusted EBIT margin of around 8 percent.”

Other dates and additional information

NORMA Group will publish its figures for the first quarter of 2023 on May 9, 2023. The Annual General Meeting will be held as an attendance event on May 11, 2023, in Frankfurt.

Additional information on the business results can be found here. For press photos, please visit our Press Area.

Contact