NORMA Group closes out 2023 with a robust result and forecasts slightly positive business development for 2024

Maintal, Germany, March 26, 2024

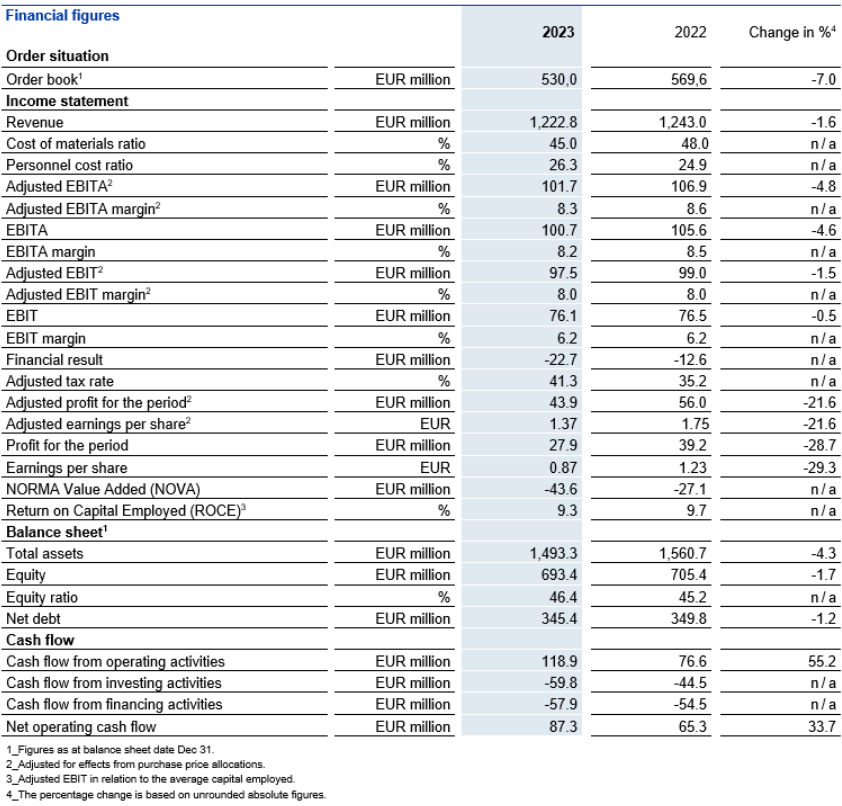

- Group sales of EUR 1,222.8 million in 2023; organic growth of 0.7 percent

- Adjusted EBIT at EUR 97.5 million; adjusted EBIT margin at 8.0 percent

- Dividend of EUR 0.45 per share proposed

- Forecast for 2024: Group sales of around EUR 1.2 to 1.3 billion; adjusted EBIT margin of around 8.0 to 8.5 percent

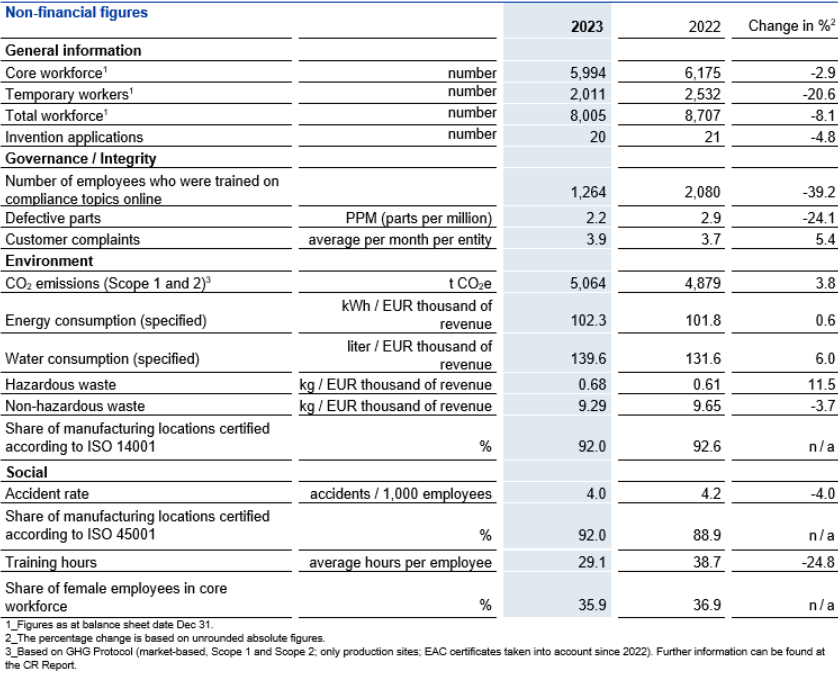

In financial year 2023, despite a challenging market environment, NORMA Group still managed to achieve a robust margin that was in line with the forecast. Thanks to increased levels of efficiency in production and logistics, the company achieved profitability at the prior year level despite a slight decline in sales. The company forecasts slightly positive business development for the 2024 financial year.

Group sales in the 2023 financial year amounted to EUR 1,222.8 million (2022: EUR 1,243.0 million). The company achieved organic growth of 0.7 percent over the previous year. There was, however, a 2.4 percent burden on sales growth from negative currency effects in connection with the US dollar and the Chinese renminbi yuan. Overall, Group sales were down slightly, declining 1.6 percent compared to the previous year. Growth momentum came from business with joining technology for vehicles (Mobility & New Energy) in Europe. What was at times weaker demand in key customer industries in America had a negative impact: In the first half of the year, business with water management products in the US was weaker due to extreme weather conditions. Strikes that took place in the fall and the subsequent production stoppages at major American automotive manufacturers had a negative impact on the automotive joining technology business.

CEO Guido Grandi: “Despite the difficult market conditions, we achieved robust profitability that was in line with our forecast. With our ‘Step Up’ improvement program, we have succeeded in making ourselves more efficient and achieved an important interim goal. We will continue to systematically implement the program and are now putting a stronger focus on additional growth opportunities. The recently completed acquisition of the Italian irrigation specialist Teco represents an important step forward in the expansion of our water management solutions business in Europe.”

In financial year 2023, adjusted earnings before interest and taxes (adjusted EBIT) totaled EUR 97.5 million (2022: EUR 99.0 million). The adjusted EBIT margin was 8.0 percent (2022: 8.0 percent). Earnings and margin were impacted by factors such as higher personnel costs. In addition to inflation-related wage increases, there were additional expenses for extra shifts and temporary workers especially in the first half of the year to reduce production backlogs at European plants. Reduced material costs had a positive effect. Overall, more efficient management of production and logistics capacities were key to achieving robust profitability. Especially in the fourth quarter, the adjusted EBIT margin of 8.0 percent was well above the level of the prior year (Q4 2022: 6.4 percent).

The net operating cash flow of EUR 87.3 million was well above the prior year figure (2022: EUR 65.3 million). The equity ratio was higher compared to the previous year at 46.4 percent as of the balance sheet date for financial year 2023 (December 31, 2022: 45.2 percent). Net debt was EUR 345.4 million at the end of December 2023, a slight decrease of 1.2 percent compared to the previous year (December 31, 2022: EUR 349.8 million).

CFO Annette Stieve: “We have a sound financial position and long-term financing. This gives us the flexibility to invest in the future growth of our three strategic business units Water Management, Industry Applications and Mobility & New Energy.”

Organic growth in Europe and Asia, decline in the Americas

In the Americas region, sales in 2023 declined organically by 4.5 percent year-on-year while currency effects reduced sales growth by an additional 2.4 percent. Overall, sales in the region reached EUR 534.5 million (2022: EUR 574.2 million), down 6.9 percent compared with the previous year. In the first half of the year, the US water business was weaker than in the same period of the previous year due to a weather-related one-off effect, but recovered again over the course of the year. Business with joining technology for industry applications declined. Sales of joining technology for passenger cars and commercial vehicles were also lower, partly as a result of strikes at US vehicle manufacturers that lasted several weeks in the fall.

In the EMEA region (Europe, Middle East and Africa), sales in 2023 grew organically by 5.7 percent. Negative currency effects reduced growth marginally by 0.5 percent. Overall, sales in the region grew by 5.2 percent compared to the previous year to EUR 514.7 million (2022: EUR 489.2 million). The Mobility & New Energy business with joining solutions for cars with all types of drive systems increased significantly by 6.8 percent. In Industry Applications, sales rose by 0.6 percent thanks to improved product availability.

In the Asia-Pacific region, there was organic sales growth of 4.0 percent in 2023. Demand for joining technology from Chinese automotive manufacturers in particular increased compared with the previous year, leading to higher business volumes in the region. The sales increase was, however, offset by negative currency effects (-7.4 percent), meaning that sales in the region fell by 3.3 percent overall to EUR 173.6 million (2022: EUR 179.6 million).

Dividend proposal: EUR 0.45 per share

The Management Board and Supervisory Board of NORMA Group will propose to the Annual General Meeting on May 16, 2024, distribution of a dividend of EUR 0.45 per share to the shareholders for financial year 2023. This corresponds to a planned distribution volume of around EUR 14.3 million and a payout ratio of 32.7 percent of the adjusted net profit of EUR 43.9 million in financial year 2023. This proposal is in line with the long-term sustainable dividend policy, which envisages a payout ratio of 30 to 35 percent of adjusted net profit.

Forecast for 2024: Stable sales and reliable profitability

NORMA Group anticipates Group sales of around EUR 1.2 billion to around EUR 1.3 billion for financial year 2024.

- For the Americas region, NORMA Group expects sales in the range of around EUR 530 million to EUR 550 million in 2024. The water management business is expected to remain stable. Business with automotive customers is, on the other hand, expected to be weaker.

- For the EMEA region, NORMA Group forecasts sales in the range of around EUR 500 million to EUR 550 million in 2024. Growth will likely be driven by continued good demand from the European automotive industry and positive development in the Industry Applications sector.

- In the Asia-Pacific region, NORMA Group expects sales in the range of around EUR 170 million to EUR 200 million in 2024. Demand is expected to develop well in all business units.

In terms of profitability, the company expects an adjusted EBIT margin of about 8.0 to 8.5 percent for 2024. Net operating cash flow is expected to be in the range of around EUR 80 million to EUR 110 million.

Guido Grandi: “Overall economic development will remain difficult also in the current financial year. The wars in Ukraine and the Middle East in particular, combined with their potential impact on global supply chains, represent key influencing factors. For this reason, I am looking ahead to business development this year with caution. Our primary goal is to be a reliable partner for our customers, employees and shareholders in a challenging market environment and to reliably meet the expectations placed on us.”

Quarterly figures and Annual General Meeting in May

NORMA Group will publish its figures for the first quarter of 2024 on May 7, 2024. The Annual General Meeting will be held as an in-person event on May 16, 2024, in Frankfurt/Main.

Additional information on the business results can be found here. For press photos, please visit our Press Area.

Contact